Trump got the idea of no tax on tips from United States Supreme Court decision, Snyder vs United States, that said bribes are tips now.

‘Bribe’ vs. ‘Tip’ – The Implications of Snyder v. United States for Companies

So Trump’s new plan to eliminate taxes on tips will include folks that make a lot of money I KNOW the history and the story behind this.

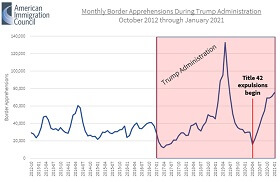

2017 – Trump is President – Employers would pocket $5.8 billion of workers’ tips under Trump administration’s proposed ‘tip stealing’ rule

People that worked for tips remember this.

People IN the industry know: Trump Is About to Make Tip-Pooling Legal Again. Here’s What That Means for Restaurant Workers

“Trump Is About to Make Tip-Pooling Legal Again. Here’s What That Means for Restaurant Workers

Gratuities could be split between servers and cooks, or kept for the house” “The Trump Administration’s Department of Labor wants to allow restaurateurs to collect tips earned by front-of-house staff and redistribute them as they see fit.

This could help shore up the growing pay inequality between cooks and servers.

This could also mean employers could keep tips for themselves or the business.Update: The public has until February 5, 2018 to comment on the rule, which was officially proposed today, before it goes into effect.” “If just-announced changes to Department of Labor regulations go past the proposal stage, employers will be able to pool tips earned by servers, allowing them to share the tips with untipped employees like cooks, dishwashers, and others in the back of house — if they share them at all.

The proposed changes, first announced in July, roll back the Obama administration’s 2011 regulations that expressly prohibited the distribution of tips to anyone other than the front-of-house staff who earned them. Backers argue it’s a regulation that could go a long way towards erasing income inequality between back and front of the house. Others say it’s a recipe for a host of evils, ranging from tip-pocketing by management to unsustainably high labor costs. All optimists and skeptics can seem to agree on is this: It’s complicated.”

You didn’t know this, did you?

Why did Kamala wait and announce her “No Tax on Tips” Plan in Las Vegas? Where a lot of people work for tips? Because people that work for tips usually don’t pay ANY Income Tax – Trump Is About to Make Tip-Pooling Legal Again. Here’s What That Means for Restaurant Workers

“Trump’s no tax on tips proposal wouldn’t benefit tipped workers” “Two-thirds of restaurant workers who work for tips earn so little that they don’t pay federal income taxes, per a new report parsing data from the Census Bureau’s American Community Survey.

Why it matters: Last month, former President Trump proposed eliminating taxes on tips — part of his more explicit appeal to the working class — but it’s hard to see how that would benefit workers. It might even hurt them in the long run.”

BUT Donald J. Trump’s No Tax On Tips plan can apply to Hedge Fund Managers, Realtors, Lawyers and other professional services – instead of being PAID for a service they can accept a TIP for doing it

Only 2.5% of workers would benefit from no taxes on tips—and in the long term, it could hurt them

Harris, Trump see votes in not taxing tips. Experts see trouble.

“Generally speaking, they argue that it’s a bad idea to give tax advantages to one sort of income — tips — over other kinds of wages. Giving preferential treatment to tipped income will, among other things, give workers making regular wages more of an incentive to try to reclassify their income as tips.

As with any potentially lucrative tax change, enterprising lawyers and financial advisers will also hunt for loopholes or windows to exploit.

Before Harris backed the idea, progressive groups particularly criticized the Cruz bill for not doing enough to prevent better-off white-collar workers from trying to pass off their wages as tips.

The Republican bill “contains few, if any, guardrails to prevent high-income professionals such as hedge fund managers from shifting their compensation to a tax-free tipping model,” wrote Brendan Duke of the Center for American Progress.

A Harris campaign official, who was not authorized to speak publicly, said that the vice president would work with Congress to include income restrictions and other guardrails to ensure a tip-exemption would not be exploited by the wealthy.”

No tax on tips: Why politicians love it, and economists don’t

“In response, a Harris campaign official told NPR that the vice president’s policy proposal is distinct from Trump’s — and she intends to deliver on it. As president, she would work with Congress to craft a proposal that comes with an income limit and with strict requirements to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy,” the official, who isn’t authorized by the campaign to speak publicly, said. “Vice President Harris would push for the proposal alongside an increase in the minimum wage.””

Like most WONK policies, people hear the sound bites without a clue what is really taking place.