GOP attacks Biden as anti-oil-production. They are lying,

U.S. Shatters Oil Production Records in 2023

- “The U.S. produced over 4.49 billion barrels of crude oil in 2019, and this record has been exceeded in 2023.

- The Energy Information Administration’s data indicates that the U.S. achieved this milestone around December 15, with a conservative estimate of 13.0 million barrels per day.

- Alongside oil, the U.S. is also on track to set a new production record for natural gas this year.

The U.S. set a new annual oil production record on December 15, based on data from the Energy Information Administration. Although the official monthly numbers from the EIA won’t be released for a couple of months, we can calculate that a new record has been set based on the following analysis.

For reference, the previous record was set in 2019, the year before the Covid-19 pandemic impacted the oil industry. Total U.S. crude oil production in 2019 was 4.49 billion barrels (source), or 12.3 million barrels per day (BPD). Then the pandemic hit, and oil production fell in 2020 and 2021, before rebounding in 2022.”

The United States is producing more oil than any country in history

“As the world grapples with the existential crisis of climate change, environmental activists want President Joe Biden to phase out the oil industry, and Republicans argue he’s already doing that. Meanwhile, the surprising reality is the United States is pumping oil at a blistering pace and is on track to produce more oil than any country has in history.

The United States is set to produce a global record of 13.3 million barrels per day of crude and condensate during the fourth quarter of this year, according to a report published Tuesday by S&P Global Commodity Insights.

Last month, weekly US oil production hit 13.2 million barrels per day, according to the US Energy Information Administration. That’s just above the Donald Trump-era record of 13.1 million set in early 2020 just before the Covid-19 crisis sent output and prices crashing.”

Meanwhile, record profits for Big Oil, 2024:

5 Big Oil Companies Likely Gave Shareholders Record Payouts for 2023: IEEFA Estimate

“Five of the top Big Oil companies in the world were expected to pay shareholders over $100 billion for 2023.

The estimated 2023 payouts from BP, Shell, Chevron, ExxonMobil and TotalEnergies were on track to surpass the dividend payments and share buybacks from 2022, which reached $104 billion, according to the Institute for Energy Economics and Financial Analysis (IEEFA).

“At the current pace of distributions via share buybacks and dividends, these five super-majors could set a record for distributions to shareholders in 2023, topping the $104 billion spent during the 2022 calendar year,” Trey Cowan, an analyst at IEEFA, told The Guardian.

According to International Energy Agency (IEA), the entire oil and gas industry made $4 trillion in 2022, a record high. But the industry experienced a decline in profits for 2023, according to IEEFA.

In 2022, ExxonMobil saw record-breaking profits of $56 billion. As of Q3 in 2023, the company’s profits had declined compared to its 2022 profits, The Associated Press reported.”

2023:

Big Oil rakes in record profit haul of nearly $200 billion, fueling calls for higher taxes

POINTS

- “Altogether, the five Big Oil companies reported combined profits of $196.3 billion last year, more than the economic output of most countries.

- Flush with cash, the energy giants have used their bumper earnings to reward shareholders with higher dividends and share buybacks.

- Big Oil executives have sought to defend their rising profits amid a barrage of criticism, typically highlighting the importance of energy security in the transition to renewables and suggesting higher taxes could deter investment.”

“The West’s five largest oil companies raked in combined profits of nearly $200 billion in 2022, intensifying calls for governments to impose tougher windfall taxes.

French oil giant TotalEnergies on Wednesday reported full-year profit of $36.2 billion, doubling last year’s total, as fossil fuel prices soared following Russia’s full-scale invasion of Ukraine.

The results see TotalEnergies join supermajors Exxon Mobil, Chevron, BP and Shell in recording a massive upswing in annual profits, after Exxon’s 2022 haul of $56 billion marked a historic high for the Western oil industry.

Altogether, the five Big Oil companies reported combined profits of $196.3 billion last year, more than the economic output of most countries.”

Exxon smashes Western oil majors’ earnings record with $56 billion profit for 2022

“HOUSTON, Jan 31 (Reuters) – Exxon Mobil Corp (XOM.N) posted a $56 billion profit for 2022, the company said on Tuesday, taking home about $6.3 million per hour last year, and setting not only a company record but a historic high for the Western oil industry.”

Chevron annual profit doubles to record $36.5 billion, but fourth-quarter miss hits shares

“Chevron on Friday posted a record $36.5 billion profit for 2022 that was more than double year-earlier earnings, but the bottom line fell shy of Wall Street estimates, undercut by asset writedowns and rising costs.

The second-largest U.S. oil producer’s adjusted net profit for 2022 exceeded its previous record set in 2011 by about $10 billion. Still, higher expenses and weaker oil and fuel profits left fourth-quarter earnings 6.6% below Wall Street’s forecast, according to Refinitiv data.”

I replied to a litany of GOP lies about Biden and Oil and Gas

Biden approves largest oil, gas lease sale in US history, steamrolls eco review with inflation bill

“The Inflation Reduction Act reinstates Lease Sale 257, an oil and gas sale spanning 80.8 million acres across the Gulf of Mexico”

The price of gas is Not Biden or any other elected officials fault. How do I know that?

Gas Prices Around the World

“You might be feeling pain at the pump, but it could be worse; gas is a lot more expensive in some other countries.”

“The Price of Gas is High regardless of type of government or political leaning of said government.

On “May 30, United States $4.79”

Countries higher than that?

“Australia $5.45

Belgium $8.10

Brazil $5.78

Canada $6.49

China $5.50

Denmark $10.02

France $8.06

Finland $9.64

Germany $8.80

Greece $9.29

Hong Kong $11.21

Iceland $9.47

India $5.09

Ireland $7.91

Israel $8.24

Italy $7.78

Jordan $6.30

Malawi $6,32

Netherlands $9.20

Norway $10.70

Poland $6.52

Singapore $8.76

Sweden $9.05

Turkey $5.80

Ukraine $6.51

Oil companies, driven by shareholders, are raking in record profits.

Oil Companies Are Making Record Profits—but Not More Jobs

“An analysis of job numbers shows that the industry still hasn’t rehired everyone it laid off during the pandemic, despite huge profits.”

Largest oil and gas producers made close to $100bn in first quarter of 2022

“Shell made $9.1bn in profit, almost three times what it made in the same period last year, while Exxon raked in $8.8bn”

2 wild charts show how Big Oil profits are skyrocketing as prices at the pump rise

- “Oil firms raked in massive first-quarter profits as gas prices hit record highs and demand surged.

- The blowout quarterly performances have raised concerns of price gouging in the high-inflation environment.

- With gas prices acting as a major source of inflation, scrutiny of Big Oil’s profits is at a fever pitch.”

The price of a barrel of oil went negative under COVID. Few commuters driving to work. Fewer people taking public transportation. Far fewer people flying for work or fun. Not many folks driving to visit grandma.

US oil prices turn negative as demand dries up

Record profits to catch up from COVID and because Oil Companies are between a rock and a hard place. With more and more electric cars being produced each year,

Global EV Sales for 2021

and electric Semis becoming a viable option,

Oil companies are wary of building new refineries or investing in a lot of upgrades in existing ones.

Sidenote: I was in CAD/CAM for 30 years. Plant Design was one of the packages I supported and I have visited Shell in The Hague, BP in London, CFP in Paris, TOTAL in Pau and Mobil (Exxon) in New York.

Someone saw the future of buggy whips when the car was starting to be made. Some saw the future of VCRs and Video Rentals when On Demand, DVR and streaming was on the horizon. Someone made the last payphone booth. The last CRT TV. Someone bought the last 8-track player made.

Oil refineries are making a windfall but keep closing

“Oil refineries across the country are being retired and converted to other uses as owners balk at making costly upgrades and America’s pivot away from fossil fuels leaves their future uncertain.”

Big Oil didn’t invest in more drilling and more refineries under Trump

In Q1, Four of Five Oil Majors Paid More Cash to Investors Than They Made From Operations

“Weak Cash Flows Forced Oil Majors to Find Other Means to Fund Shareholder Distributions”

The oil industry actually hasn’t done that well under Trump

“The oil industry’s fortunes have been withering on President Donald Trump’s watch, with dozens of oil companies falling into bankruptcy as weak crude prices take a toll on the sector he contends would be abolished if he’s not reelected.”

No president, senator, congressman or any elected official, in any country, is the reason the price of gas, worldwide, is what it is today.

Pain at the gas pump is being felt around the world

“Across the globe, drivers like Mueller are rethinking their habits and personal finances amid skyrocketing prices for gasoline and diesel, fueled by Russia’s war in Ukraine and the global rebound from the COVID-19 pandemic. Energy prices are a key driver of inflation that is rising worldwide and making the cost of living more expensive.”

“There’s a global oil price — around $110 a barrel — but no global pump price due to taxes and other factors. In Hong Kong and Norway, you can pay more than $10 per gallon. In Germany, it can be around $7.50 per gallon, and in France, about $8. While lower fuel taxes mean the U.S. average for a gallon of gas is somewhatcheaper at $5, it’s still the first time the price has been that high.”

A video:

Drilling?

NATURAL GAS

Crude Oil

Biden and Oil Leases and Permits? The GOP Lie?

Fact-checking Biden’s claim that there are 9,000 unused oil drilling permits

Joe Biden: The oil industry has “9,000 permits to drill now. They could be drilling right now, yesterday, last week, last year.”

PolitiFact’s ruling: Mostly True

Here’s why: President Joe Biden said that his policies have not made the U.S. less equipped to withstand the impact of the ban on Russian energy imports. He contended that the onus is on U.S. oil and gas companies that have permits to begin drilling, but haven’t started.

“It’s simply not true that my administration or policies are holding back domestic energy production,” Biden said March 8 in a speech announcing a U.S. ban on Russian oil imports. Biden said that companies pumped more oil in the U.S. during his first year in office than during his predecessor’s first year and that we were on track for record oil production next year. Then Biden pivoted to point the finger at the industry:

“In the United States, 90% of onshore oil production takes place on land that isn’t owned by the federal government. And of the remaining 10% that occurs on federal land, the oil and gas industry has millions of acres leased,” Biden said. “They have 9,000 permits to drill now. They could be drilling right now, yesterday, last week, last year. They have 9,000 to drill onshore that are already approved.”

The status of drilling permits during Biden’s administration

The U.S. has more than 24 million acres under lease to oil and gas companies onshore — close to half are not producing.

Before drilling can occur, the lease holder has to get a federal permit. At the end of 2021, there were 9,173 approved and available permits to drill on federal and Indian lands. Those permits include those issued under Biden and those still active from Trump’s administration and potentially before, said Josh Axelrod, of the National Resources Defense Council. Companies don’t have to immediately begin drilling as their leases last 10 years and can be extended beyond that.

From a federal regulatory standpoint, once a permit is approved, industry can proceed.

9,173 PERMITS (Not Leases)

KeystoneXL Pipeline? Another Bogus GOP Talking Point?

High gas prices falsely attributed to Keystone XL cancellation

“AP’S ASSESSMENT: False. The Keystone XL crude oil pipeline wasn’t yet operational when it was canceled in 2021, and wasn’t expected to be running until 2023. Rather, experts say gas prices are high due to other factors such as the global spike in the cost of crude oil and increased demand after pandemic lockdowns ended.”

Ask FoxNews

Six reasons Keystone XL was a bad deal all along

- “Keystone XL Would Not Reduce Foreign Oil Dependency

- Keystone XL Would Have Increased Domestic Oil Prices

- Keystone XL Overstated Number of Jobs to be Created

- Current Keystone Pipeline Leaked 12 Times in Last Year

- The Environmental Concerns About Oil Leaks Are Justified

- Mining Tar Sands Would Worsen Global Warming”

What Is the Keystone XL Pipeline?

“How a single pipeline project became the epicenter of an enormous environmental, public health, and civil rights battle.”

By the way,

US Supreme Court deals blow to Keystone oil pipeline project

“BILLINGS, Mont. (AP) — The U.S. Supreme Court handed another setback to the Keystone XL oil sands pipeline from Canada on Monday by keeping in place a lower court ruling that blocked a key environmental permit for the project.”

I tried to explain this to the GOP:

High gas prices complicate Democrats’ hopes of picking up US House seats in California

H.R.7688 – Consumer Fuel Price Gouging Prevention Act

2 wild charts show how Big Oil profits are skyrocketing as prices at the pump rise

- “Oil firms raked in massive first-quarter profits as gas prices hit record highs and demand surged.

- The blowout quarterly performances have raised concerns of price gouging in the high-inflation environment.

- With gas prices acting as a major source of inflation, scrutiny of Big Oil’s profits is at a fever pitch.”

Oil giants reap record profits as war rages in Ukraine, energy prices soar: Here’s how much they made

“Key Points

- Following Russia’s invasion of Ukraine in February, the price of oil climbed in 2022’s first quarter.

- Shell’s adjusted earnings, for example, rose to $9.1 billion, while Exxon Mobil reported $5.48 billion in profits.

- Rising prices have boosted the profits of major energy companies, further contributing to global inflation and the cost-of-living crisis.”

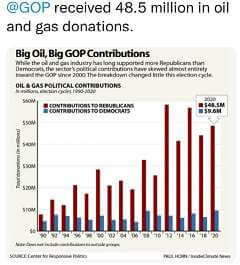

One Party gets the vast majority of Political Contributions from Big Oil

Top Contributors, 2021-2022

Top Recipients

Must-Watch Video:

Citizens United v FEC Got Us Here

Big Oil Hates Regulation so they LOVE Republicans

Climate Change?