We will be documenting our fair, equitable, tax plan here.

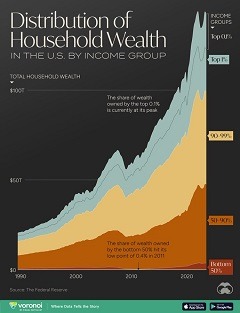

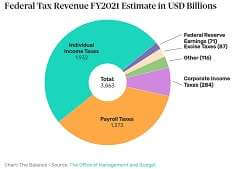

Fiscal Facts

We will be repealing the GOP Tax ‘Cut. NOT the cut you and we got, the cut Corporations and 1%ers got.

Example? BERKSHIRE HATHAWAY INC 2017 ANNUAL REPORT

“To the Shareholders of Berkshire Hathaway Inc.: Berkshire’s gain in net worth during 2017 was $65.3 billion, which increased the per-share book value of both our Class A and Class B stock by 23%. Over the last 53 years (that is, since present management took over), per share book value has grown from $19 to $211,750, a rate of 19.1% compounded annually.*

The format of that opening paragraph has been standard for 30 years. But 2017 was far from standard: A large portion of our gain did not come from anything we accomplished at Berkshire. The $65 billion gain is nonetheless real – rest assured of that. But only $36 billion came from Berkshire’s operations. The remaining $29 billion was delivered to us in December when Congress rewrote the U.S. Tax Code.“

That $29 billion exceeded their previous years NET EARNINGS!

Corporations Use Services

The Plan

Make the tax cuts for middle class and lower taxpayers permanent.

Repeal the tax cut that corporations and those over $75K received.

We WILL Balance the Budget! We will calculate the tax revenue needed and rates need to achieve that income in conjunction with the budget (expenses).

A Message From the Billionaire’s Club: Tax Us

The financier George Soros is part of a group of wealthy individuals calling for “a moderate wealth tax on the fortunes of the richest one-tenth of the richest 1 percent of Americans — on us.”CreditFabrice Coffrini/Agence France-Presse — Getty Images

If they have this much money for political campaigns, then they can afford to pay a little more in taxes

Top Individual Contributors: All Federal Contributions

https://www.opensecrets.org/overview/topindivs.php