Federal Budget

Breaking Down the US Federal Budget | Charts and Graphs

Mandatory spending

Current Federal Mandatory Spending

“Mandatory spending is estimated to be $2.966 trillion for FY 2021.1 The two largest mandatory programs are Social Security and Medicare. That’s 37% of all federal spending. It’s almost two times more than the military budget.”

https://www.thebalance.com/current-federal-mandatory-spending-3305772

So we have to raise $2.966 Trillion Dollars

Discretionary Spending

Current U.S. Discretionary Spending

“Discretionary spending is the part of the U.S. federal budget that Congress appropriates each year. For Fiscal Year 2021, President Donald Trump requested $1.485 trillion.1″

https://www.thebalance.com/current-us-discretionary-federal-budget-and-spending-3306308

Spreadsheet Time

| Mandatory | $2,966,000,000 |

| Discretionary | $1,485,000,000 |

| Total | $4,451,000,000 |

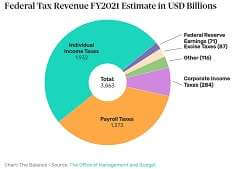

Revenue

US Federal Government Tax Revenue

“In fiscal year (FY) 2021, income taxes will account for 50%, payroll taxes make up 36%, and corporate taxes supply 7%. The rest is made up of estate taxes, excise and custom duties, and interest on the Federal Reserve’s holdings of U.S. Treasurys.”

https://www.thebalance.com/current-u-s-federal-government-tax-revenue-3305762

“Income taxes will contribute $1.932 trillion. Another $1.373 trillion will come from payroll taxes. This includes $1.011 trillion for Social Security, $308 billion for Medicare, and $43 billion for unemployment insurance. Corporate taxes will add another $284 billion. The Tax Cut and Jobs Act cut taxes for corporations much more than it did for individuals. In 2015, corporations paid 11%, and income taxpayers paid 47%.

The Federal Reserve, whose revenue comes from a variety of sources, contributes $71 billion. The Fed is the bank for federal government agencies, and it pays interest on the billions of dollars in operating funds deposited by these agencies. In addition, the Fed owns $4 trillion in U.S. Treasury securities that it acquired through quantitative easing.2

The remainder of federal revenue comes from excise taxes ($87 billion), tariffs on imports ($54 billion), estates taxes ($22 billion), and miscellaneous receipts ($40 billion).”

https://www.thebalance.com/current-u-s-federal-government-tax-revenue-3305762

Spreadsheet Time

| Income Tax | $1,932,000,000 |

| Payroll Tax | $1,373,000,000 |

| Corporate Tax | $284,000,000 |

| Federal Reserve | $71,000,000 |

| Excise Tax | $87,000,000 |

| Tariffs | $54,000,000 |

| Estate Tax | $22,000,000 |

| Miscellaneous | $40,000,000 |

| Total | $3,863,000,000 |

Tax Brackets

The question is how many people are in each bracket?

Summary of the Latest Federal Income Tax Data, 2020 Update

“The bottom 50 percent of taxpayers (taxpayers with AGIs below $41,740) faced an average income tax rate of 4.0 percent.”

https://taxfoundation.org/summary-of-the-latest-federal-income-tax-data-2020-update/

“As household income increases, the IRS data shows that average income tax rates rise. For example, taxpayers with AGIs between the 10th and 5th percentiles ($145,135 and $208,053) paid an average effective rate of 14.3 percent—3.5 times the rate paid by those in the bottom 50 percent.

The top 1 percent of taxpayers (AGI of $515,371 and above) paid the highest effective income tax rate, roughly 26.8 percent, more than six times the rate faced by the bottom 50 percent of taxpayers.”

https://taxfoundation.org/summary-of-the-latest-federal-income-tax-data-2020-update/

Estate Taxes?

Here Are the 2020 Estate Tax Rates

“All that sounds convoluted, but the real takeaway is that if you have less than $11.58 million in assets, you don’t have to worry about estate tax in 2020. And even if you are that wealthy, there are still things you can do to prevent tax problems after your death.”

https://www.fool.com/taxes/2019/11/11/here-are-the-2020-estate-tax-rates.aspx

I close this ‘loophole’- first $100,000 is free form Estate Tax and $100,001 and up is taxed at 40%

Corporate Tax Rate?

The Corporate Tax Rate in the United States stands at 21 percent.

The 2017 GOP Tax Cut gave Berskshire-Hathaway $29 Billion (with a B!)

“The $65 billion gain is nonetheless real – rest assured of that. But only $36 billion came from Berkshire’s operations. The remaining $29 billion was delivered to us in December when Congress rewrote the U.S. Tax Code.“

https://www.berkshirehathaway.com/2017ar/2017ar.pdf

So the question is if everyone gets to earn their first $100,000 tax-free, what does that do the effective tax rates? I have a great idea! Let’s make some adjustments, see where we get to, and adjust from there.

The Plan

Step 1 – Repeal the 2017 GOP Tax Cut

Step 2 – Return Corporate Tax Rate to pre-2017 Tax Cut Rate of 35% – Corporations Use Services Too

Step 3 – Create a 3-tier tax bracket (Remember, for ALL tax brackets the first $100,000 is not taxed)

- $100,001 to $500,000 – 30%

- $500,001 to $2,000,000 – 35%

- $200,000,001 and up – 40%

Step 4 – We address the Estate Tax – 40% of everything over $100,000

Step 5 – To Recover from COVID-19 – Issue ‘Virus’ Bonds – just like War Bonds.

Step 6 – Cut Military and Discretionary Spending 20% across the board. (Social Security, Medicare, Medicaid and Unemployment Insurance and NOT entitlements, recipients paid into their funding for the sole purpose of needing that money some day and to help others) (Military Spending? If there is enough left over for “The Wall” then perhaps they are getting too much to begin with?)

Step 7 – At the end of the Fiscal Year, balance the books and adjust tax rates and spending accordingly, with a goal of raising revenue no more than 10% and reducing discretionary spending no more than 10% each year until a year of zero debt is achieved.

What do you think?