Did Trump’s tax cuts boost hiring? Most companies say no

The 2017 Tax Cuts Didn’t Work, The Data Prove It

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises

“A 2025 Course Correction Is Needed”

They want more tax cuts and less regulation:

Billionaires are cozying up to Trump

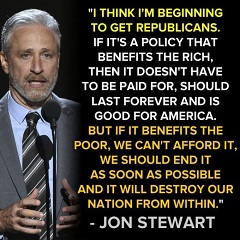

A Great Example!

Meet the Billionaire and Rising GOP Mega-Donor Who’s Gaming the Tax System

Did the 2017 tax cut—the Tax Cuts and Jobs Act—pay for itself?

Did the Tax Cuts and Jobs Act Pay for Itself in 2018?

U.S. companies post their biggest profit growth in decades by jacking up prices during the pandemic

“Corporate pretax profits surged 25% year over year to $2.81 trillion, the Bureau of Economic Analysis said on Wednesday. That’s the largest annual increase since 1976, according to the Federal Reserve.

When taxes are factored in, last year’s corporate profit increases were even more of an outlier. They soared 37% year over year, more than any other time since the Fed began tracking profits in 1948.”

‘Tax These Moochers’: Top 1% Dodge $163 Billion in Taxes Each Year

Twitter Thread:

Patagonia’s $10 million donation: Why they gave away their US tax savings

Asking Wealthiest Households to Pay Fairer Amount in Tax Would Help Fund a More Equitable Recovery

50 years of tax cuts for the rich failed to trickle down, economics study says

On Tax Day, Still ‘No Evidence’ Trump Tax Cuts Are Trickling Down to Workers

Column: Trickle-down theory is a monstrous lie intended to justify the rich getting richer

Bezos, Buffett, Bloomberg, Musk, Icahn and Soros pay tiny fraction of wealth in income taxes, report reveals

THE BIG FAT LIE THAT STARTED IT ALL: INVESTORS ARE JOB CREATORS

Republicans, Not Biden, Are About to Raise Your Taxes

Senate tax bill would cut taxes of wealthy and increase taxes on families earning less than $75,000 by 2027

After 2 Years, Trump Tax Cuts Have Failed To Deliver On GOP’s Promises

Exclusive: U.S. taxpayers’ virus relief went to firms that avoided U.S. taxes

As 100,000 die, the virus lays bare America’s brutal fault lines – race, gender, poverty and broken politics

I turned 60 this year – Am I going to get angry?

America’s billionaires have become even richer since Donald Trump became president, and it says a lot about the country’s record-high wealth gap

The average worker isn’t seeing Trump’s “economic miracle.” Here’s why.

Trump cites ‘serious economic conditions’ in proposing 1% pay raise for federal employees

Trump moves to cap pay raise for civilian government workers at 1 percent

The Great Affordability Crisis Breaking America

‘We’re technically homeless’: the eviction epidemic plaguing the US

Trump to Propose $4.8 Trillion Budget With More Border Wall Funding

Trump budget plan would fail to eliminate deficit over 10 years, briefing document shows

Forget Trump’s Lies, Here’s the Real Economic State of the Union

January 31, 2020:

U.S. Midwest manufacturing activity hits 4-year low

Five Good Reasons It Doesn’t Feel Like The Trump Tax Cut Benefited You

So the Tax Cut didn’t pay for itself

NATIONAL DEBT INCREASED BY $3 TRILLION DURING DONALD TRUMP’S THREE YEARS AS PRESIDENT

SO

Trump Opens Door to Cuts to Medicare and Other Entitlement Programs

2017

Highest Median Household Income on Record?

“Without adjusting for the change in the income questions, 2017 has the highest median household income on record (since 1967). When you adjust for the change, median household income in previous years was just as high.“

https://www.census.gov/library/stories/2018/09/highest-median-household-income-on-record.html

2018

U.S. Median Household Income was $63,179 in 2018, Not Significantly Different from 2017

Opinion: What ever happened to Trump’s boast of 4%, 5% or even 6% growth?

8 Things That Are Becoming Less Affordable for the Middle Class

Many millennials are worse off than their parents — a first in American history

Who Killed the Knapp Family?

CEO compensation has grown 940% since 1978

“Typical worker compensation has risen only 12% during that time”

https://www.epi.org/publication/ceo-compensation-2018/

Wage Growth Tracker

In 2010, Keith Olbermann NAILED it!

“Be prepared then for the reduction of taxes for the wealthy and for the corporations“

https://limbaugh2020.com/keith-olbermann-nailed-it-citizens-united-v-fec-caused-our-nations-anger-now

Source: WalletHub

The real wage myth

NYT report reveals truth about Trump tax cuts

https://limbaugh2020.com/amazon-will-pay-0-in-taxes-on-11200000000-in-profit-for-2018/

Trump Claims the Economy Is the Best Ever—These 11 Facts Tell a Different Story

Railroads are slashing workers, cheered on by Wall Street to stay profitable amid Trump’s trade war

Two years later, every promise made about the GOP tax cuts has been broken

Trump promised ‘America First’ would keep jobs here. But the tax plan might push them overseas.

TRUMP PROMISED TAX CUTS WOULD BRING BACK JOBS, BUT GM WORKERS IN OHIO FEEL BETRAYED.

‘A slap in the face’: AT&T workers upset jobs slashed despite Trump tax cuts

The Last Shift: What Really Happened To Those Carrier Jobs Trump Saved

Trump Lied!

Trump Thinks the U.S. Could See 6% Economic Growth. The Data Says Otherwise.

Trump and GOP promised economic growth much better than Obama’s. That’s not what happened

NEW CONGRESSIONAL REPORT FINDS 2017 TAX CUTS DID NOT LIVE UP TO PROMISES

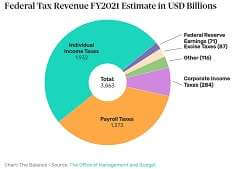

One jarring chart shows how taxes on workers have essentially replaced those on corporations

A new report hands Democrats a major weapon against Trump

Corporations paid 11.3 percent tax rate last year, in steep drop under Trump’s law

“TO COHN’S CLAIM, I WOULD SAY, ‘GIVE ME A BREAK’”: GARY COHN TRIES—AND FAILS—TO DEFEND THE TRUMP TAX CUT

Why aren’t wages rising faster even with low unemployment? Trade war, weaker economy are among reasons

Almost half of all Americans work in low-wage jobs

White House weighing proposal to tighten eligibility for disability benefits

Trump, Who Slashed Taxes by $1.5 Trillion, Is Pushing Cuts to Food Stamps

THIS!

USDA fights to purge food stamps recipients despite pandemic

Olbermann nailed this too!

“and the elimination of the social safety nets for everybody else, because money, spent on the poor“

https://limbaugh2020.com/keith-olbermann-nailed-it-citizens-united-v-fec-caused-our-nations-anger-now

This hits our Active Duty Military and our Poor!

Military and Food Stamps

‘A terrible time to be poor’: Cuts to SNAP benefits will hit 700,000 food-insecure Americans

Including people who suddenly need food stamps!

U.S. Steel to lay off 1,500 people and shutter factories near Detroit

Total Trump food-stamp cuts could hit up to 5.3 million households

When does GOP and Trump realize this hits Red states far worse than Blue states?

A Closer Look at Who Benefits from SNAP: State-by-State Fact Sheets

Trump’s Food Stamp Cuts Will Be Devastating to Trump Country

Most & Least Federally Dependent States

Trump administration’s plans for SNAP are a shove down, not a hand up

How cuts to food stamp program could increase ‘poor outcomes’ for the food insecure

Giving Tuesday can’t fix the damage Trump’s tax ‘reform’ did to charities

Trump administration proposes Social Security rule changes that could cut off thousands of disabled recipients

NEARLY TWO-THIRDS OF AMERICANS SAY TRUMP HAS NOT HELPED THEIR FINANCIAL STANDING

Opinion: Inflation inequality deepens wage losses for America’s poorest

Trump administration proposal endangers food stamps for millions

Researchers Find A Remarkable Ripple Effect When You Give Cash To Poor Families

Beneath the surface, cracks in the economy

The GOP Tax Cuts Didn’t Work

How FedEx Cut Its Tax Bill to $0

” WASHINGTON — In the 2017 fiscal year, FedEx owed more than $1.5 billion in taxes. The next year, it owed nothing. What changed was the Trump administration’s tax cut — for which the company had lobbied hard.”

https://www.nytimes.com/2019/11/17/business/how-fedex-cut-its-tax-bill-to-0.html

Under Trump, the deficit has ballooned, exploding a GOP myth

The wealth tax plan worrying US billionaires

Wealthy Americans will receive billions in tax cuts if Obamacare is overturned, new report says

US debt surpasses $23 trillion for first time

https://limbaugh2020.com/white-houses-kudlow-22-5-trillion-debt-is-not-a-huge-problem/

Trump Administration Scaling Back Rules Meant to Stop Corporate Inversions

White House officials ramp up new tax cut talks, as Trump seeks sharp contrast with 2020 Democrats

2016 GOP Platform Promised a Balanced Budget!

Trump’s Tax Cut Underdelivers, Which Could Embolden Democrats Who Want It Reversed

Trump is even losing on the economy

U.S. economic growth slows to 1.9% in the third quarter

GDP shows U.S. economy’s growth tapers to 1.9% in 3rd quarter

Debt, Doomsayers and Double Standards

Symbol of ’80s Greed Stands to Profit From Trump Tax Break for Poor Areas

Two years in, Trump tax cuts not on course to pay for themselves

Taxing the Rich to Fund Welfare Is the Nobel Winner’s Growth Mantra

U.S. government’s annual budget deficit largest since 2012

Federal deficit increases 26% to $984 billion for fiscal 2019, highest in 7 years

Schumer: Democrats will try to overturn tax deduction cap

Trump Claims He Boosted U.S. Incomes by $7,000. Data Say Otherwise

Making America Worse

America’s richest 400 families now pay a lower tax rate than the middle class

For the first time in history, U.S. billionaires paid a lower tax rate than the working class last year

American billionaires paid less in taxes in 2018 than the working class, analysis shows — and it’s another sign that one of the biggest problems in the US is only getting worse

The Ultra-Wealthy Who Argue That They Should Be Paying Higher Taxes

Trump Weighs Weakening Obama Rules to Curb Corporate Inversions

Economists think the slowdown will only get worse

Consumers power the economy — so what happens now that wage gains are falling?

U.S. labor market seen as still-healthy despite payrolls miss, economists say

Trump Administration Unveils More Cuts to Food Stamp Program

Some are paying more now. I received a $308 tax cut in 2017 ($26 a month)

Here’s Why Some People Are Now Paying More Under Trump’s Tax ‘Cut’

How much did Berkshire-Hathaway get?

Warren Buffett’s Berkshire Hathaway made $29 billion off the Republican tax cuts

To the Shareholders of Berkshire Hathaway Inc.: Berkshire’s gain in net worth during 2017 was $65.3 billion, which increased the per-share book value of both our Class A and Class B stock by 23%. Over the last 53 years (that is, since present management took over), pershare book value has grown from $19 to $211,750, a rate of 19.1% compounded annually.*

The format of that opening paragraph has been standard for 30 years. But 2017 was far from standard: A large portion of our gain did not come from anything we accomplished at Berkshire. The $65 billion gain is nonetheless real – rest assured of that. But only $36 billion came from Berkshire’s operations. The remaining $29 billion was delivered to us in December when Congress rewrote the U.S. Tax Code. (Details of Berkshire’s tax-related gain appear on page K-32 and pages K-89 – K-90.)

GOP tax plan favors the richest, analysis shows

Richest Americans—Including Bezos, Musk And Buffett—Paid Federal Income Taxes Equaling Just 3.4% Of $401 Billion In New Wealth, Bombshell Report Shows

“ProPublica found that while the median American household earning roughly $70,000 per year paid 14% in federal taxes each year, the 25 richest Americans (by Forbes’ tally) paid a “true tax rate” of just 3.4% on wealth growth of $401 billion between 2014 and 2018.”

2016 GOP Platform Promised a Balanced Budget!

Treasury: US deficit tops $1 trillion in 11 months

Trump says Fed ‘boneheads’ should cut interest rates to zero ‘or less,’ US should refinance debt

Trump Administration Unveils More Cuts to Food Stamp Program

A cynical way to make poor people disappear

How Trump’s Plan to Redefine Poverty Would Impact Health Care and Food Stamps

Opinion: Trump’s cuts to food stamps are indefensible, economically and morally

Ahead of election year, more Americans lack health insurance, incomes stall

Trump said he’d rebuild manufacturing. Now it’s in decline. What happened?

DID BILLIONAIRES PAY OFF REPUBLICANS FOR PASSING THE TRUMP TAX BILL?

Study Finds Trump Tax Cuts Failed to Do Anything But Give Rich People Money

How a Trump Tax Break to Help Poor Communities Became a Windfall for the Rich

Billionaire Koch Brothers Invest Millions More to Promote Tax Overhaul

The Koch Brothers’ Best Investment

How a $40 million political outlay yields a $500 million tax cut.

https://prospect.org/article/koch-brothers-best-investment

ANALYSIS: KOCH BROTHERS COULD GET UP TO $1.4 BILLION TAX CUT FROM LAW THEY HELPED PASS

2017 financials of the Koch’s dark money network

Fox News and Trump’s Own Adviser Call BS on His Boast About the Economy

U.S. manufacturing shrinks for first time in three years

Trump’s tax cut isn’t giving the US economy the boost it needs

U.S. created 500,000 fewer jobs since 2018 than previously reported, new figures show

Trump pledged to save US factories — but a key measure of manufacturing just contracted for the first time since 2009

Graphic: Factory woes grip swing states that flipped for Trump in 2016

In the Race for Factory Jobs Under Trump, the Midwest Isn’t Winning

In Economic Warning Signals, Trump Sees Signs of a Conspiracy

Move over, Illuminati. The conspiracy against Trump’s economy is massive.

Trump phoned bank CEOs as stock market plunged Wednesday: report

U.S. Budget Deficit Already Exceeds Last Year’s Total Figure

Fiscal Facts

Our View: Deficit would be zero if not for tax cuts

“Growth will pay for this”

Growth is NOT Paying for THIS!

Recount shows Trump didn’t get his 3% growth in 2018 after all

U.S. Economy Slows, Denying Trump 3% Talking Point

The US Economy Reverts To A Pre-Tax Cut Growth Rate

Trump adds $4.1 trillion to national debt. Here’s where the money went

Treasury to Borrow Over $1 Trillion in 2019 for Second Year in a Row

GDP revised downward for 2018 as U.S. economy shows more signs of slowing

The U.S. economy grew 2.2 percent in the final quarter of last year, the Commerce Department said Thursday, less than the 2.6 percent the government initially estimated and another sign of a slowdown.

President Trump, however, has focused on how fast the economy grew in 2018, which was widely expected to be a strong year after the GOP tax cuts and infusion of more government spending. Trump contends the economy is taking off, while most economists say growth peaked last year.

Trump has been touting 3.1 percent economic growth in 2018. But officially, the Commerce Department said Thursday, the economy grew 2.9 percent last year.

This Year’s GDP?

Gross Domestic Product

Obama’s GDP?

Real Gross Domestic Product (GDPC1)